when will capital gains tax increase be effective

But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Further Biden is proposing a hike to the long-term capital gains rate to 396.

Taxing Capital Gains At Ordinary Rates Evidence Says Do It So Does Buffett Jared Bernstein On The Economy

Dems eye pre-emptive capital gains effective date.

. Capital Gains Tax Increase. This resulted in a 60. However the real gain after adjusting for the doubling of the.

Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax increase would lower federal revenue by 33 billion. Personal Income Tax I. This may be why the White House is.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Capital gains on the. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis.

MAXIMUM TAX RATE ON CAPITAL GAINS. Hed like to raise the top rate on income taxes to 396 from 37. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

When a business is sold most of the sale amount is allocated to goodwill and taxed at capital gains rates often pushing the owners remaining income into. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent.

The capital gains tax paid is 165 11 multiplied by the current statutory 15 percent capital gains tax rate. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. Currently the top rate on those.

If that change occurs effective in 2022 one way to protect yourself is by accelerating income from 2022 into 2021. Here are the details. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

If the top federal capital gains rate rises to 434 percent this would raise the combined tax rate on long-term capital gains to 484 percent. Note that short-term capital gains taxes are even higher. Web when will capital gains tax increase be effective Thursday March 10 2022 Edit Washington implemented a 7 percent tax on long-term net capital gains in excess of.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. Its time to increase taxes on. Long-Term Capital Gains Taxes.

This resulted in a 60.

Capital Gains Vs Ordinary Income The Differences 3 Tax Planning Strategies Kindness Financial Planning

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

Capital Gains Tax Guide Napkin Finance

Advisers Blast Biden S Retroactive Capital Gains Proposal

Amid Inequality Debate In Japan Capital Gains Tax Hike May Have Unintended Effect The Japan Times

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Figure A Increase In The Effective Capital Gains Tax Rate By Income Group Download Scientific Diagram

The Tax Impact Of The Long Term Capital Gains Bump Zone

Estimated Income Tax Spreadsheet Mike Sandrik

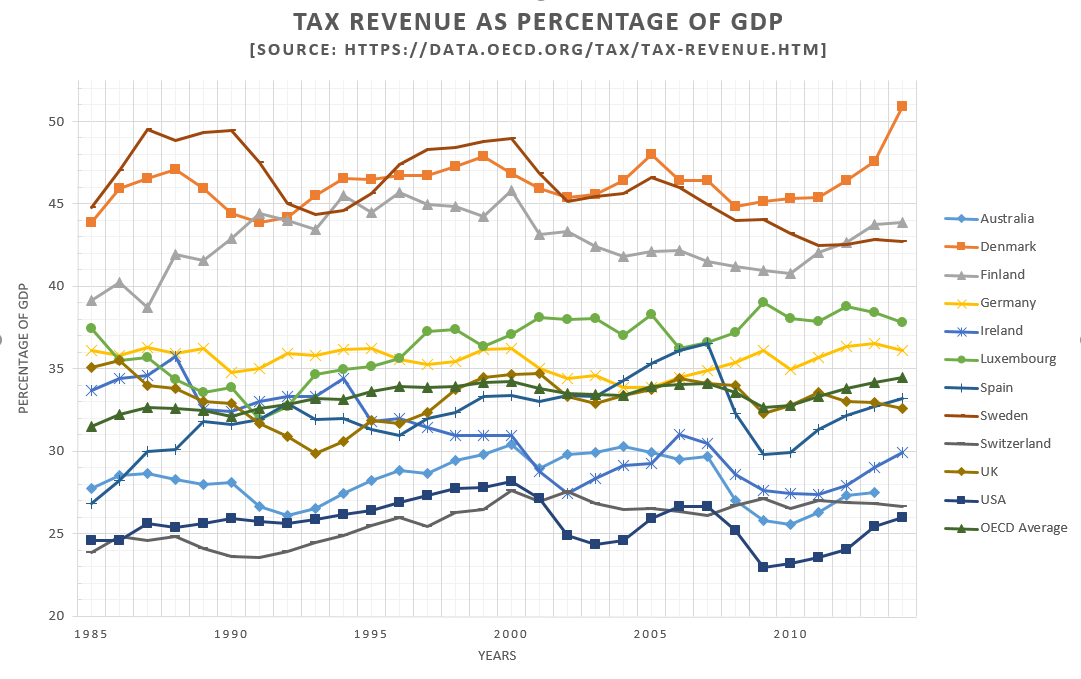

No Link Between Capital Gains Taxes Gdp

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Tax Policy Center Espouses Minority View On Capital Income Taxes Tax Foundation

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Opinion Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Marketwatch

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

New Tax Initiatives Could Be Unveiled Commerce Trust Company